Media Contact: Beth McGroarty

[email protected] • +1.213.300.0107

Global Wellness Institute Releases “Global Wellness Economy Monitor” – Packed with Regional & National Data on Wellness Markets

U.S. is by far the #1 national market, and key trends like mental wellness and more affordable products/services will boom in an age of Trump, income inequality and uncertainty

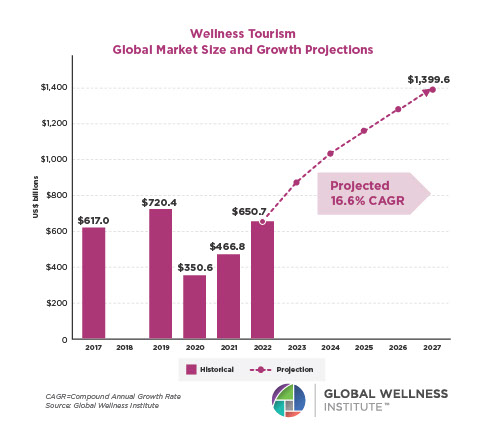

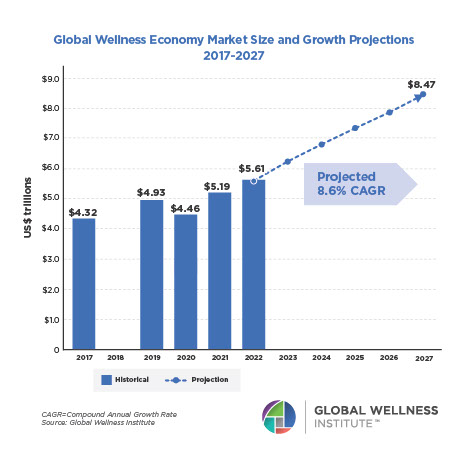

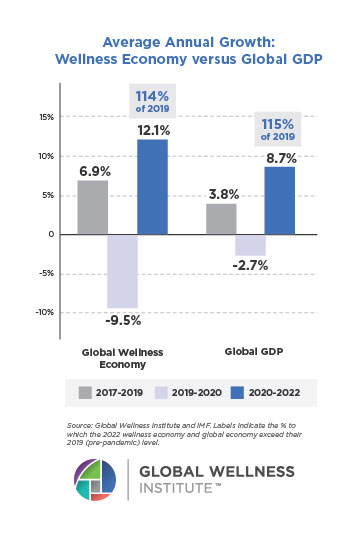

Miami, FL– January 31, 2017 – The Global Wellness Institute (GWI) today released the 2016 Global Wellness Economy Monitor, the only research that measures and analyzes the ten markets (from fitness/mind-body to wellness tourism) that comprise the global wellness industry. Pre-released data revealed that the worldwide wellness industry grew an impressive 10.6%, to $3.72 trillion, from 2013-2015 (while the global economy shrank -3.6%) – making it one of the world’s fastest-growing, most resilient markets.

“The growth trajectory of the wellness industry appears unstoppable,” said GWI’s senior researchers, Katherine Johnston and Ophelia Yeung. “And the report released today contains a wealth of data on regional markets: from the top 20 national markets for wellness travel, spa and workplace wellness to how fast key markets will grow through 2020 to the first regional data on the emerging wellness real estate category.”

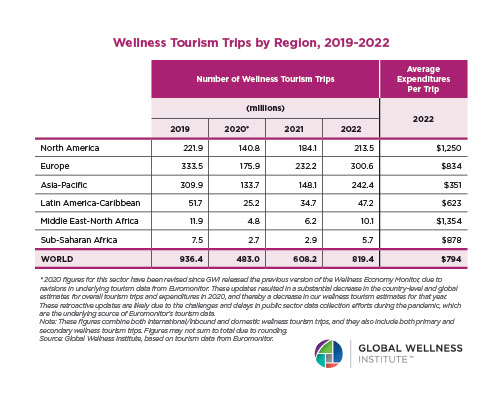

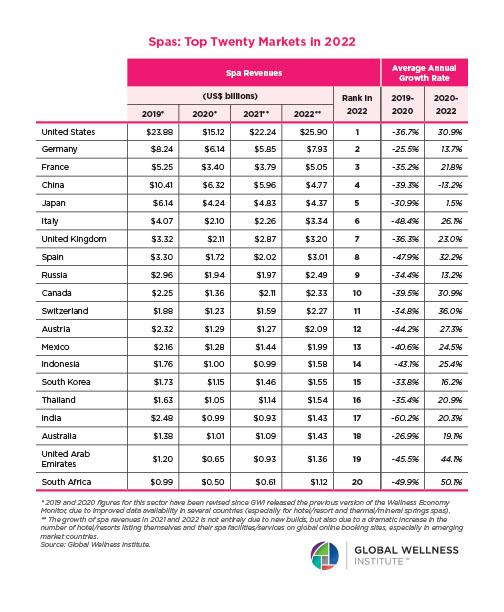

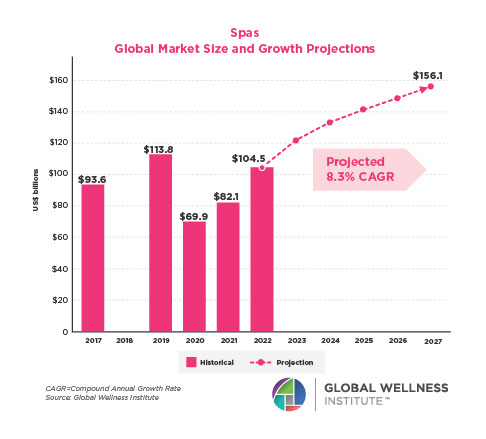

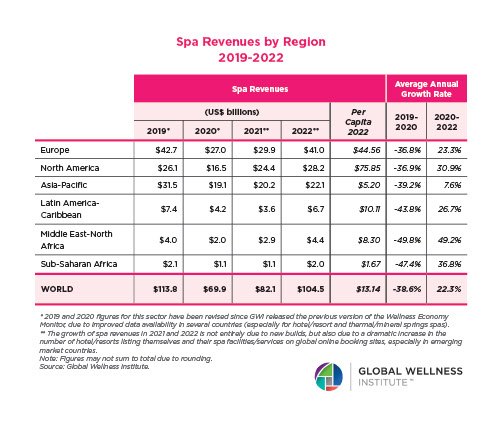

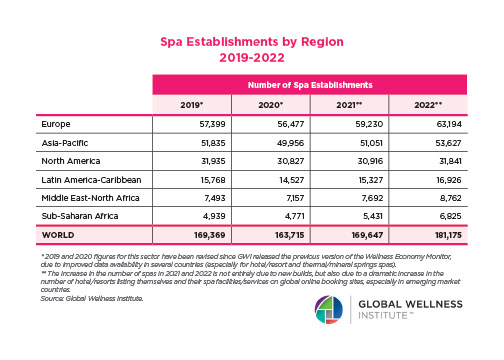

From the fact that China drove the biggest recent gains in wellness tourism revenues (300%+) to the fact that Sub-Saharan Africa is the fastest-growing spa market (40% spike in revenues), you can access it all IN THE FULL REPORT HERE.

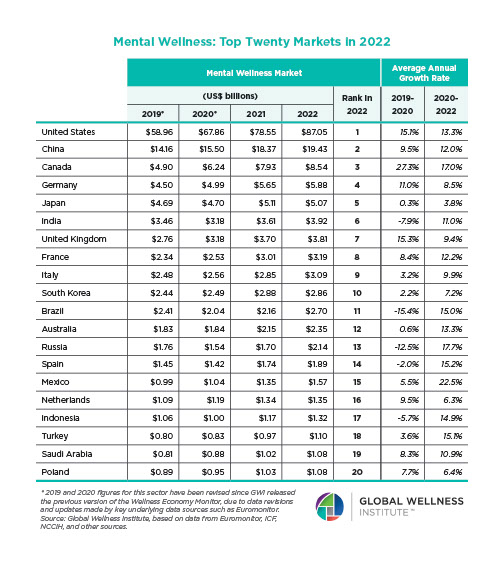

U.S. Is #1 “Wellness Nation”

With the research released at a press event in NYC, a spotlight was on new data for the United States market, indicating that it is the dominant national wellness industry. The GWI produces original research on five markets: wellness tourism, the spa industry, workplace wellness, wellness real estate and thermal/mineral springs, and the U.S. ranked #1 among nations (typically overwhelmingly) for revenues in four of five of those markets (except for thermal/mineral springs, where it ranks 18th globally).

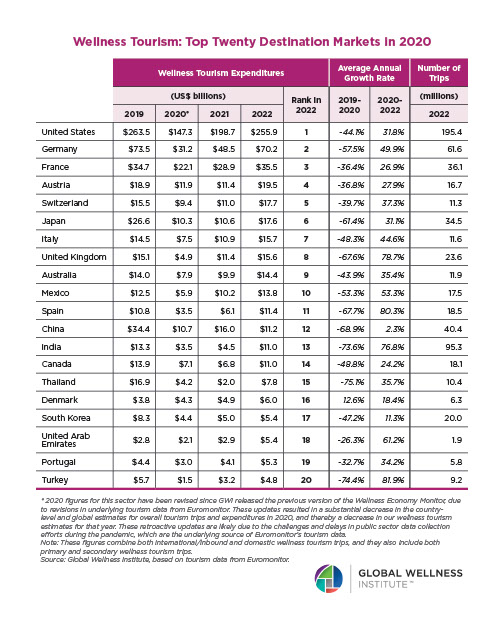

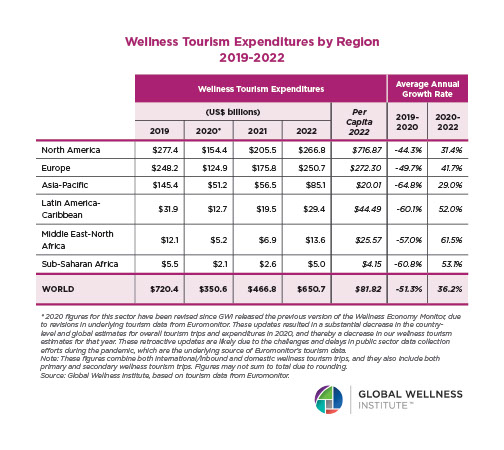

U.S. Drives Nearly 4 in 10 Wellness Travel Dollars Spent: The U.S. is the wellness travel powerhouse, generating 36%, or $202.2 billion, of the annual $563.2 billion global market. That’s three times more wellness tourism spending than the second largest market, Germany, at $60.2 billion. U.S. wellness trips jumped from 141.4 million in 2013 to 161.2 million in 2015, and revenues grew 5.8% each year.

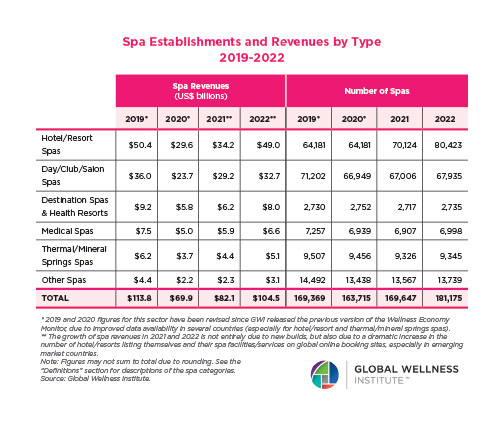

Spa Market 2X Bigger than Any Other: Global spa facilities now generate $77.6 billion annually. And the U.S. is twice as big a spa market as its next closest competitor, China.

Top 3 Spa Markets (2015)

Locations Annual Revenues

#1 U.S. 24,421 $18.7 billion

#2 China 12,595 $7 billion

#3 Germany 6,488 $5.95 billion

The U.S. gained 1,569 spas from 2013-2015, while spa revenues grew 7.2% each year. The U.S. now accounts for roughly one-quarter of all global spa revenues (24%).

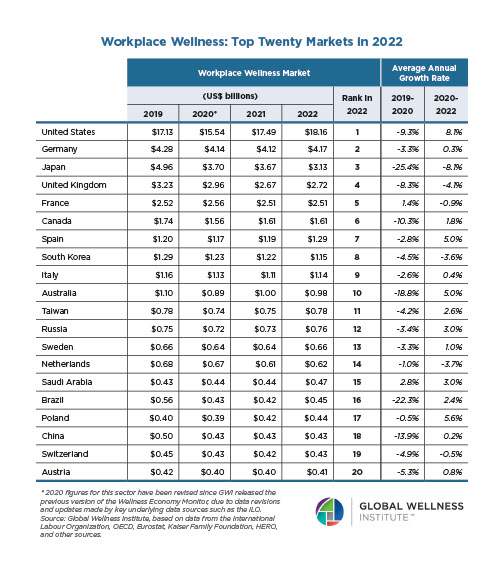

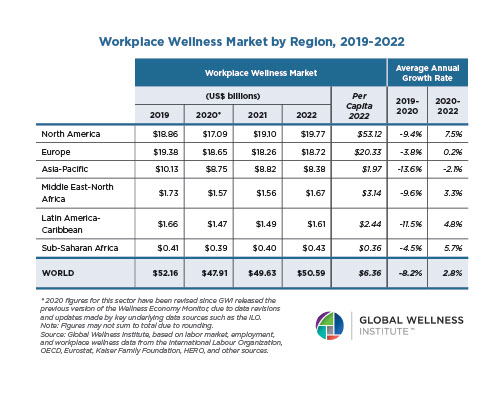

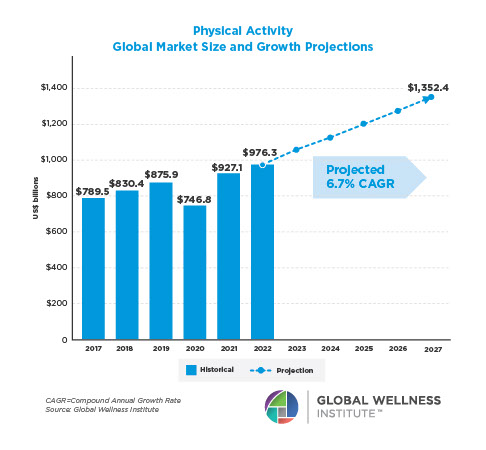

Largest Workplace Wellness Market By Far: The GWI estimates that unwell workers now cost the world’s economy 10-15% in output, so workplace wellness has grown to a $43.3 billion market. And the U.S. is the overwhelming leader, with employers spending $14.4 billion annually, four times more than the next largest markets, Japan ($3.4 billion) and Germany (3.1 billion). It’s no surprise that the U.S. represents one-third of the workplace wellness spend, and is growing at a 6.7% annual rate, because in America healthcare is typically provided by employers, who have powerful incentives to slash their costs and boost productivity.

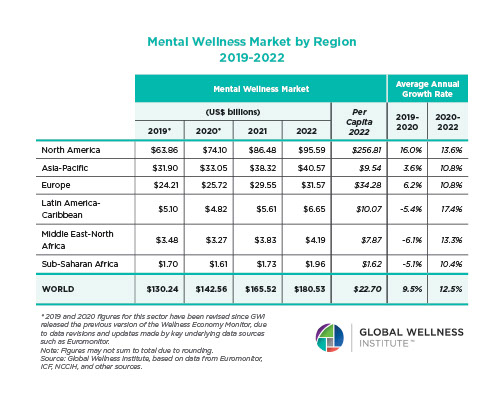

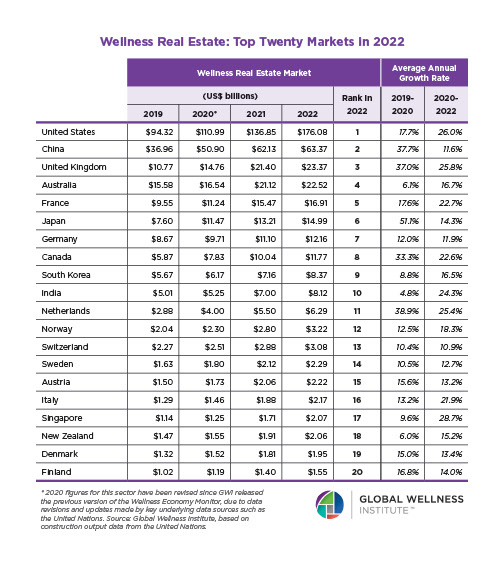

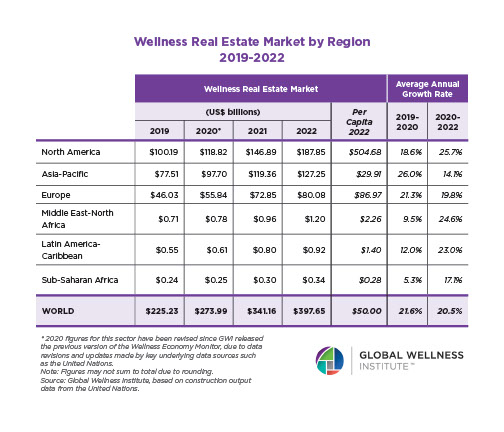

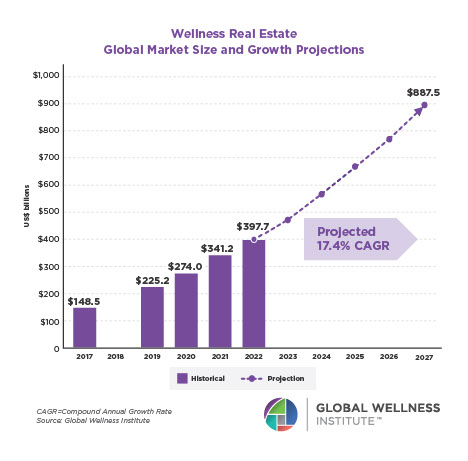

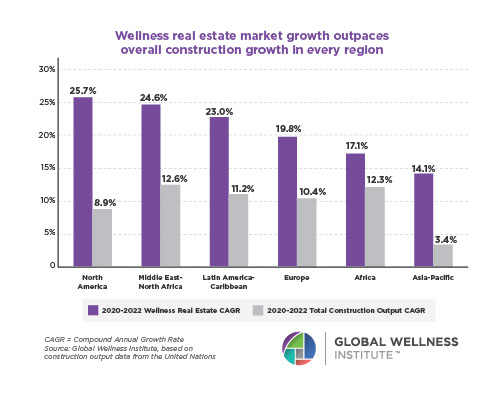

First in Wellness Real Estate: Wellness real estate – homes and communities expressly designed for residents’ physical, mental, social and environmental health – is the third-fastest growing wellness market: expanding 19% from 2013-2015 (from $100 billion to $119 billion). GWI research measures this market regionally, and North America ranks #1 ($48 billion), just ahead of Asia ($41 billion).

U.S. Wellness Trends in the Age of Trump, Income Inequality & Uncertainty

In the months since GWI’s research was completed, there has obviously been radical disruption in the U.S.: a new age of Trump and uncertainty, heightened discussions about income inequality and populism, unprecedented media/social media overload of “fake news” and “alternative facts”, as well as looming repeal of the Affordable Care Act (ACA), which experts estimate would leave 18 million without health insurance.

In light of these new realities, GWI Chairman and CEO, Susie Ellis, forecasts five trends that will sharpen in the U.S. wellness market in coming years.

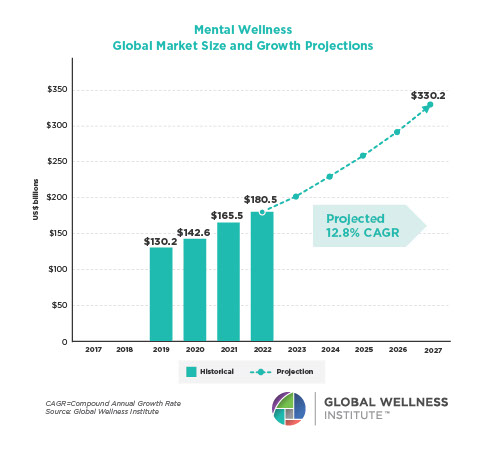

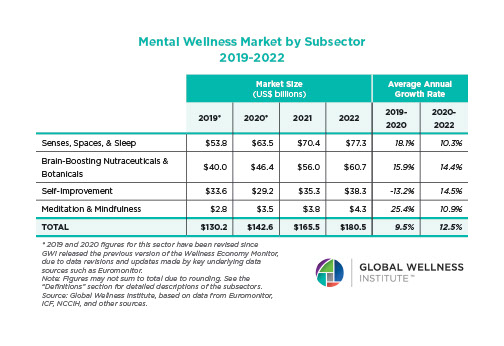

1. A SURGE in mental wellness programming at hotels, wellness resorts, spas, fitness studios, workplaces and schools

If wellness culture has historically focused far more on “body” than “mind” – mental wellness approaches will now boom in diverse directions: from meditation mainstreaming further (new drop-in studios, new breeds) – to sleep health, programs and technology hitting the tipping-point – to wellness centers/destinations bringing in psychotherapists and neuroscientists – to new, part-mind/part-body fitness brands – to new apps that track mental wellness and stress.

2. Wellness Beyond the Wellthy

In a country where income and “wellbeing” inequalities helped fuel a populist backlash, a U.S. wellness industry too associated with the 1% ($300 yoga pants and Reiki sessions) will change: wellness will get more democratized. We’ll see a wave of wellness products/services at lower price-points: new affordable healthy grocery stores (like Whole Foods 365); new healthy “fast-food” chains (like LYFE Kitchen, Sweetgreen); low-priced, wellness-focused hotels (like EVEN); more budget spa brands (like new brand, The Now in Los Angeles). And more “sliding scale” wellness: fitness classes and healthy restaurant prices based on income. And if wellness has been derided as essentially a-political, a new crop of spaces, clubs, retreats and gyms where wellness, feminism and politics interweave will appear.

3. Silence/Turn it Off!

In the American world of 24/7 connectedness and shrieking news/noise, more businesses and wellness destinations will take a radical new approach: silence and absolute disconnection. On the spa/wellness travel front this includes new “silent spas,” “wellness monasteries” in sacred spaces and deep nature, and hotels/resorts with “quiet room labels”, “Quiet Zone” floors and “digital kill switches”. Even silent restaurants, gyms, hair salons, stores and airports are appearing…

4. Wellness IS Home & Wellness AT Home The home has oddly been the last frontier in wellness, but as “outside” stress ratchets up, 2017 trends forecasters concur that Americans are becoming obsessed with their hom

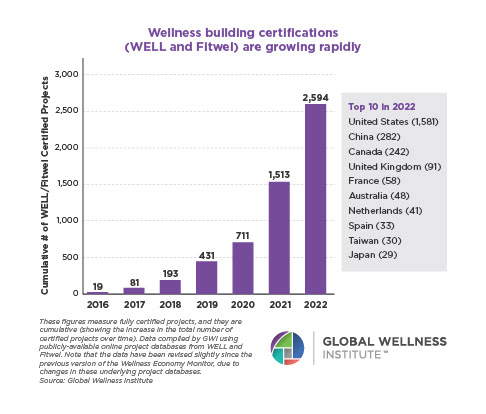

e as wellness nest/sanctuary. This obsession will continue, but deepen, from DIY wellness makeovers spanning everything from installing circadian lighting to biophilic design. A whole new “wellness architecture” will rise, tackling everything from deadly indoor air pollution to adopting new “International Well Building Standards” that certify homes around dozens of healthy-for-humans’ measures. And more Americans will choose to live in the new wellness-focused communities/real estate.

5. U.S. Wellness Markets Will Grow in Years Ahead

The U.S. and global wellness industries’ growth has proven not only resilient, but even inversely correlated with economic and “human wellbeing” downturns. With looming ACA repeal and mental and women’s health programs especially targeted – and U.S. healthcare costs forecast to rise an average of 5.8% every year through 2025* – more Americans will turn to alternative, preventative health approaches. Wellness, from yoga/meditation to exercise, will become an even more sought-after antidote for an increasingly over-connected, chaotic world.

“The UN’s ‘2016 World Happiness Report’ finds that the U.S. ranks a depressing 85th among nations when it comes to equality in wellbeing among its citizens. And now more than ever the country needs more mental wellness solutions and more wellness offerings for the ‘other 99%,’” noted GWI’s Chairman and CEO, Susie Ellis. “And because the U.S. wellness market is so vast, consumer-driven and innovative, the industry will respond to these new needs and opportunities.”

For more analysis of the mental wellness, “democratization”, silence and wellness architecture/homes trends, see the Global Wellness Summit’s report, “8 Wellness Trends for 2017” .

Research Sponsors: The “Global Wellness Economy Monitor” was underwritten with support from the following industry leaders: Spafinder Wellness, Biologique Recherche, Universal Companies, Elemis, HydraFacial, Miraval, Performance Health, The BodyHoliday, Treatwell and Two Bunch Palms.

*CMS National Health Expenditure Projections, 2015-2025

For more information, contact Beth McGroarty: [email protected]

or (+1) 213-300-0107.

About the Global Wellness Institute:

The Global Wellness Institute (GWI), a non-profit 501(c)(3), is considered the leading global research and educational resource for the global wellness industry, and is known for introducing major industry initiatives and regional events that bring together leaders and visionaries to chart the future. GWI positively impacts global health and wellness by advocating for both public institutions and businesses that are working to help prevent disease, reduce stress, and enhance overall quality of life. Its mission is to empower wellness worldwide. www.globalwellnessinstitute.org